You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. For example if you earn an income overseas you may have to pay tax on that income in the country its earned and Australia.

Income Tax Number Registration Steps L Co

Total amount paid by employer.

. The Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri Malaysia LHDN has announced that e-Filing submissions for Income Tax Returns for the 2021 year of assessment. The Union Budget 2020 reduced this period to 120 days for NRIs whose taxable Indian income exceeds Rs 15 lakh in a financial year. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020.

Therefore I am currently working from overseas. Residents and non-residents are subject to tax on Malaysian-source income only. Nonresidents are subject to withholding taxes on certain types of income.

While Budget 2022 had announced. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Till the end of FY 2019-20 NRIs including Indian citizens and PIOs included those who visited India for less than 182 days in an FY.

The amount of tax you must pay if you earn money while overseas depends on your personal circumstances. Income tax borne by employer. Other income is taxed at a rate of 30.

If you are from one of these countries then you are exempt from paying income tax to the Malaysian government. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee. LHDNM considers the employment is not exercised in Malaysia as there is no temporary absence period due to COVID-19 travel restrictions issue.

This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Exemption available up to RM2000 per annum for the following types of award long service more than 10 years of employment with the same employer past.

Therefore the employment income can be taxed under domestic tax law in the country where the. Australia has reciprocal agreements in place with only a few countries to prevent double taxation. The deadline for e-filing your income tax form is on 15 May 2022 but before that make sure you claim these tax reliefs and possibly get back some money Income tax season is upon us.

Total amount paid by employer. Here is a look at the amendments to the criteria determining residential status applicable for the current. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

Am I considered to be exercising an employment in Malaysia. Finally only income that has its source in Malaysia is taxable.

Tax Implications For Malaysians With Foreign Bank Accounts And Foreign Source Income In Overseas Cheng Co Group

What Is The Income Tax Rate For Salaried Professionals In Singapore Quora

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Greece Income Tax Rate Alternative Tax Resident Regimes

Sending Employees To China Employee Secondments And Individual Income Tax

Income Tax Rates Slab For Fy 2012 13 Or Ay 2013 14 Ebizfiling

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Esos What You Need To Declare When Filing Your Income Tax

Top 8 Countries With No Income Tax That You Should Know

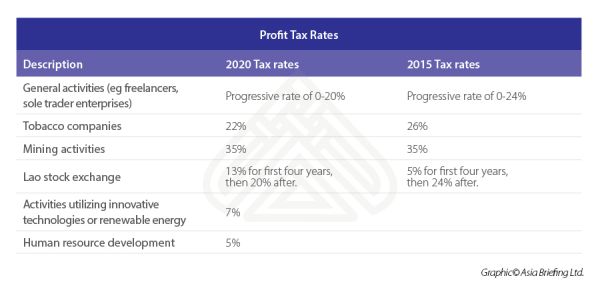

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Foreign Income Tax Malaysia Removal Of Exemptions

Foreign Sourced Income Tax Standard Chartered Malaysia

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

How To Pay Your Income Tax In Malaysia

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

All You Need To Know On Exempted Income In Income Tax Ebizfiling